In my experience of working with people who have just set up their own business, something that causes a lot of unnecessary stress and sleepless nights is tax.

- How is it calculated?

- How much will I need to pay?

- When do I need to pay it?

The truth is that you probably didn’t start your new business to worry about tax!

You likely did it because you are good at what you do and felt you could get paid more if you set up on your own. So, you put your tax on the back burner. Then, in January, you need to do something! If you speak to an accountant at this point, they may tell you that you need to pay thousands of pounds over to HMRC by the end of the month. Sorry, what…?

Well, let me explain how it all works, to hopefully help you prepare!

When you are employed, your employer deals with the tax each month by deducting it from your pay and they then pay it over to HMRC, usually each month. This is called PAYE (Pay as you earn) So, you are paying tax, but you don’t have to do anything yourself, your employer deals with it on your behalf.

When you are self-employed:

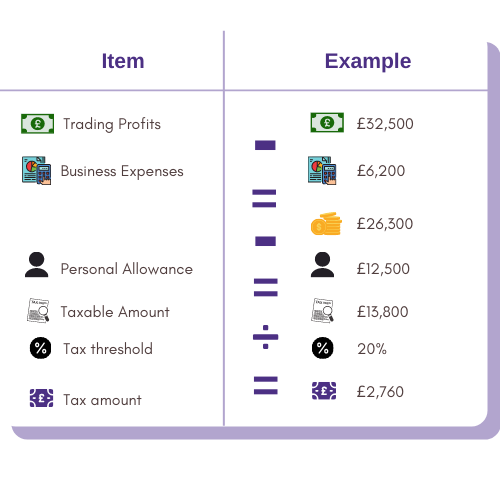

You pay tax on your trading profits. This is made up of your taxable income, less your business expenses.

Normally, you would take your trading profits for the period from 6th April to 5th April the following year. The start date might be different if you set your business up part way through the year – that’s fine. There are other circumstances where you might have a different accounting year but let’s keep it simple for this purpose.

Once you have your profit, it is this figure that goes onto your Self-Assessment Tax Return. Sometimes, tax adjustments might be required, if you have business expenses that are not tax deductible, such as entertaining customers, but again, let’s keep it simple and keep these out for now.

The tax you then need to pay is based on how much taxable profit you make.

Each individual has a personal allowance. This is currently £12,500 for 2021/22. Which means you can have annual income of up to this amount before you start paying tax. You then pay tax at 20% on income from £12,500 to £50,000 and then 40% on income over this (up to £150,000 – speak to me if you’re a sole trader expecting profits of over £50,000!!!)

Any tax payable will be due for payment by 31st January

So, it is always a good idea to understand what this figure might be as soon as you can, so that you can better plan for it.

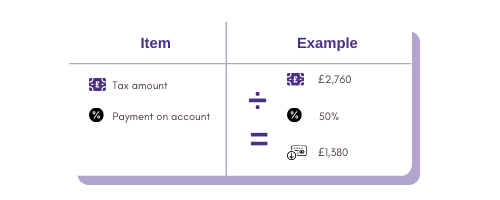

You need to be aware that, the first time your tax bill exceeds £1,000, you will also be required to make a ‘payment on account’ (in advance of next tax year) and HMRC estimates this as being 50% of the tax for this year.

You would also then be required to make a second payment on account by the following 31st July, again, in advance of next tax year.

Also, take into consideration

That in your first year of business, some or all of your personal allowance may have been taken up by your employment income. Or you may have overpaid tax on your employment income so might be entitled to have some of that refunded.

I need to mention National Insurance too, but ill leave it there with just a mention and talk about it in another blog.

There’s so much to take into consideration, no wonder people try to ignore it. I want to ignore it after writing all that!

What I suggest is to talk to an accountant early.

Make sure you’re talking to one who is proactive. You want someone to help you understand how the profit you made last month translates into tax so they can advise how much to put to one side to save for the tax bill, so you don’t get caught out the day before it is due to be paid!

If you have any questions on the above, or would like help with planning for your future tax bills, please get in touch.

Just call on 01604 662670 or email [email protected]

Martin Crooke is a Partner at Kilby Fox, we are friendly Chartered Accountants based in Northampton, sorting out the accounts for businesses in the Northamptonshire area and further. Martin has over 15 years’ experience working as an accountant for small businesses.