Payments on Account is an area that I see regularly catching out new business owners.

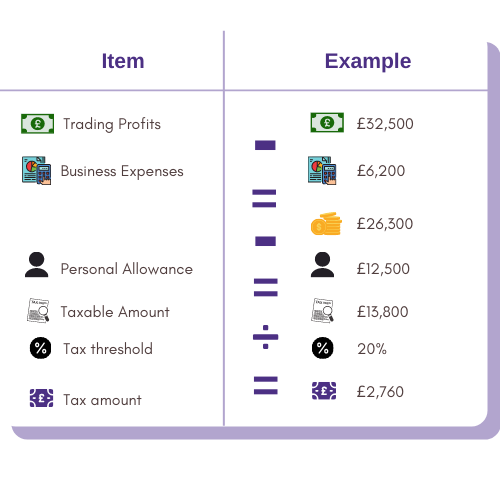

You make some profit, some is tax free, the rest gets taxed at 20%, there’s something about National Insurance in there and that’s what I pay until next January. Right?

Maybe to begin with, but likely not for long.

When you first become self-employed, it’s quite likely that your first self-assessment tax bill will be relatively low, or you may even get a tax refund.

This usually happens because you paid a chunk of tax in your employment through PAYE and, now that you’re self-employed, you perhaps haven’t made a great deal of profit in year 1, if at all, so you may be able to claim back some of the tax you paid in your old job.

If you do have a small amount of tax to pay, if its under £1,000, then you will just make your payment by 31st January and then wait for the following year for the next one.

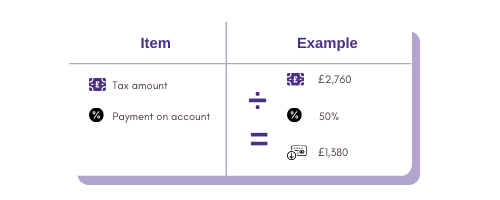

However, when your tax bill goes over £1,000, HMRC then ask you to begin making payments on account, in advance of next year’s tax bill. The amount they ask you to pay on account is 50% of this year’s tax bill, on top of what you have to pay for the year just gone. They then ask you to pay another 50% by 31st July, so by the time next January rolls around, you have already paid the same amount that you paid last year, on account.

Then, in the following January, you make a balancing payment, assuming your tax bill has gone up, plus 50% again, and it goes on and on. Very confusing!! Let me try to explain using an example. Excuse the dates being a year or too old.

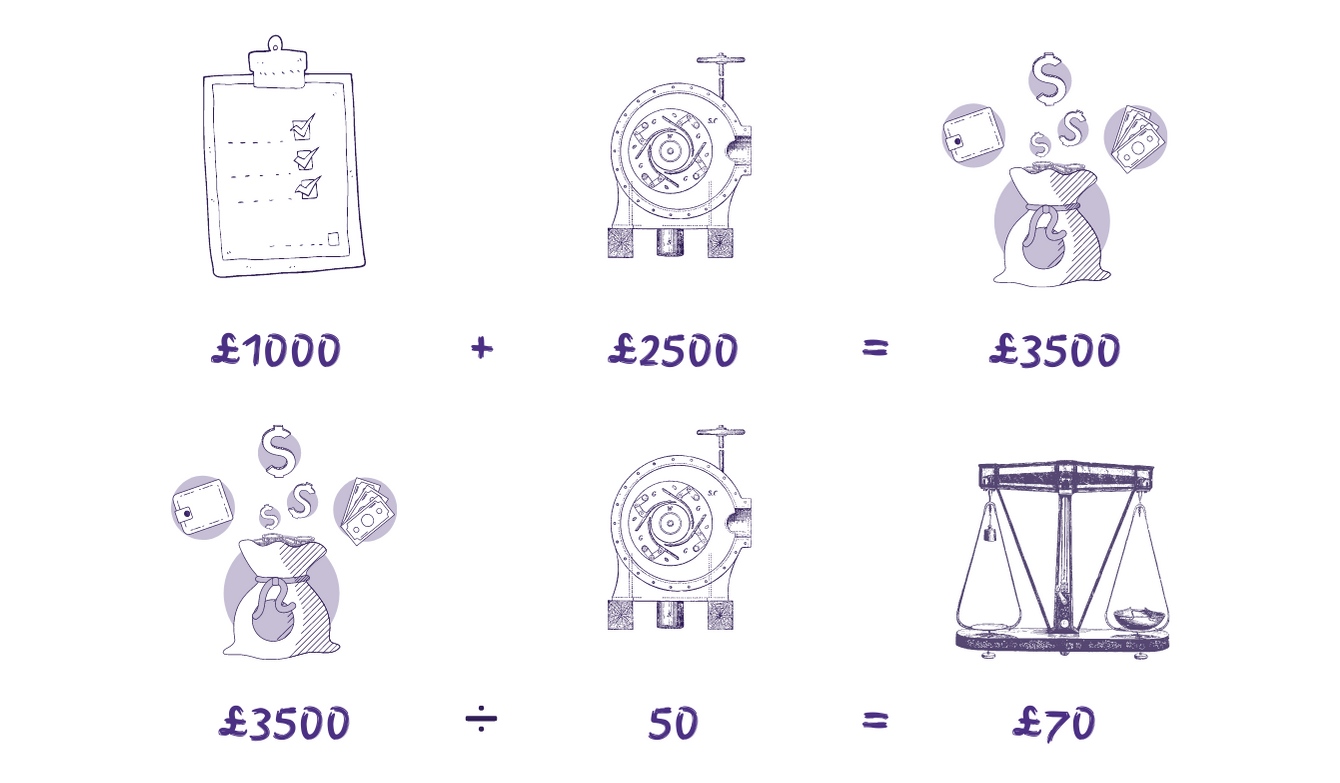

In the image above, the total tax owed for the tax year ended 5th April 2020 was £2,200. So, they paid that by 31st January 2021 but, as the amount was over £1,000 for the first time, they also had to make a payment on account, being another 50%. So, by 31st January 2021, they had to make a payment of £3,300 (£2,200 + £1,100).

They then had to make a further payment on account, being another £1,100 by 31st July 2021. So, by the time the next January rolled around, 31st January 2022, they had already paid £2,200 on account. So when they found out their tax bill for the year ended 5th April 2021 was £2,500, they only needed to pay £300, as they already paid £2,200 up front. However, they then needed to make a payment account, being 50% of the £2,500, in advance of next year.

From the image, you can see that after that first year, the amount payable each year then pretty much evens out. Its just that first year that catches people out.

Even for the super prepared; those that put 20% of their profit to one side each month. They can still get caught out by this extra 50%. So, make sure you don’t.

Ideally, you will have an accountant who will have already explained this to you and helped you plan for the tax liability throughout the year, by letting you know what profit you’re making each month, and what this will mean for tax, to include the payments on account.

Now that you are more prepared for these payments on account, you can begin to plan for them by using an accountant to prepare monthly management accounts that let you know what your profit is and what tax you should put to one side each month. If you would like regular management reports based on up-to-date information, please get in touch.

Just call on 01604 662670 or email [email protected]

Martin Crooke is a Partner at Kilby Fox Chartered Accountants in Northampton. Martin specialises in helping small business owners gain financial control of their lives so they can focus on what they do best.